Conflict of interest

Information about the Expat & Co

Conflict of Interest Policy

1. Context

Expat & Co is an insurance distributor. In this capacity, it must respect the AssurMiFID rule of conduct. Furthermore, Expat & Co is committed to acting in a fair, loyal and professional manner in the interest of its customers. This rule of conduct is known as the MiFID constitution.

Under the AssurMiFID rule of conduct, it must draft and implement a conflict of interest policy.

Expat & Co must provide all its clients with a summary of this policy. This can be done on paper or by referencing its website.

Expat & Co's conflict of interest policy must list all potential conflicts of interest that may arise among its customers and between its employees and customers.

Expat & Co's conflict of interest policy has been approved by its management.

The principles applied

Under the European MiFID (Market in Financial Instruments Directive), Expat & Co must draft and implement a conflict of interest policy and communicate it to its customers.

The MiFID was transposed into Belgian law with the Twin Peaks II Act of 30 July 2013 and the implementation decree included in the Royal Decree of 21 February 2014 relating to conflict of interest policies for insurance distributors.

The Twin Peaks II Act, together with most of its Royal Decrees, came into effect in Belgian territory on 1 May 2015.

A conflict of interest arises if, during an insurance mediation service carried out by Expat & Co, there is an opposing interest between Expat & Co and one of its customers' interests or between the interests of one or more of its customers among themselves.

The Royal Decree clearly states that the fundamental MiFID rule of conduct must be respected whenever a conflict of interest arises.

2. Conflict of interest policy

Expat & Co tries to avoid any conflicts of interest.

In the performance of their duties, Expat & Co's employees respect the fundamental AssurMiFID rules of conduct as stated in the publication by the FSMA on 1 September 2015. These rules state that all distributors and their employees must act honestly, fairly and professionally in the best interests of their customers.

Expat & Co's employees also respect the conventional rules of integrity, fairness and impartiality in their daily work.

To ensure that all employees adhere to these principles, Expat & Co has drafted procedures for the following situations:

- Expat & Co's employees take out insurance contracts for themselves and their family;

- Expat & Co's employees receive gifts and gratuities;

- If a conflict of interest arises for which it is necessary to apply the four-eyes principle, the Expat & Co employee concerned will seek the assistance of the competent person. The competent person is appointed by Expat & Co's management.

- There is a claim between two or more customers for which Expat & CO has to be impartial and may have to outsource the settlement to an independent, third-party claims representative;

- A broker, working for Expat & Co, and Expat & Co itself unknowingly prospect the same lead;

- …

With these procedures, Expat & Co will make every effort to avoid and manage potential conflicts of interest, adapting its organisation where necessary.

3. How does Expat & Co identify conflicts of interest within its operation?

Expat & Co is aware that conflicts of interest may arise during the performance of its duties.

The following list of examples of conflicts of interest was included in the legal texts:

- Making a financial profit or avoiding a loss to the detriment of a client;

- Expat & Co has an interest other than that of the customer in a particular transaction.

- Prioritising a certain customer or group of customers to the detriment of another customer or group of customers;

- Receiving greater compensation than is normally paid under the same circumstances;

- Expat & Co performs the same activity as the customer;

- The remuneration for a too-limited offer is higher than for the other products in the range;

- Expat & Co would, directly or indirectly, hold 10% or more of the voting rights or capital of any insurance company.

- An insurance company would, directly or indirectly, hold 10% or more of the voting rights or capital of Expat & Co.

4. How has Expat & Co organised itself to avoid the identified conflicts of interest?

Expat & Co has drawn up a register listing all identified conflicts of interest.

Based on this register, Expat & Co has taken all measures possible to avoid these conflicts of interest.

- Expat & Co strictly applies the established procedures;

- Expat & Co's employees receive the necessary relevant training;

- Expat & Co has put a procedure in place on receiving gifts and/or benefits from customers (remuneration policy), which is strictly respected.

- If there is any ambiguity on a specific conflict of interest, Expat & Co has a procedure for calling upon external assistance (the "competent person") when necessary.

5. What if a conflict of interest arises that is not included in the conflict of interest register?

If an Expat & Co employee determines that there is a conflict of interest that is not included in the conflict of interest register, they will execute the following procedure:

- Collect as much information as possible about the situation in question, including:

- The details of the customer concerned;

- The policy or policies concerned;

- The date on which the conflict of interest arose;

- A brief description of the conflict;

- The potential consequences for the customer(s) concerned;

- A possible solution to avoid or manage the conflict of interest;

- …

- The employee will deliver this information to the competent person;

- The competent person will take the most appropriate decision, taking the AssurMiFID rules of conduct into account.

- The customer concerned will receive this decision through a durable medium, accompanied by the necessary information. Based on this information, the customer concerned can decide on whether or not to discontinue the services.

- If the conflict of interest cannot be avoided, Expat & Co can discontinue the services.

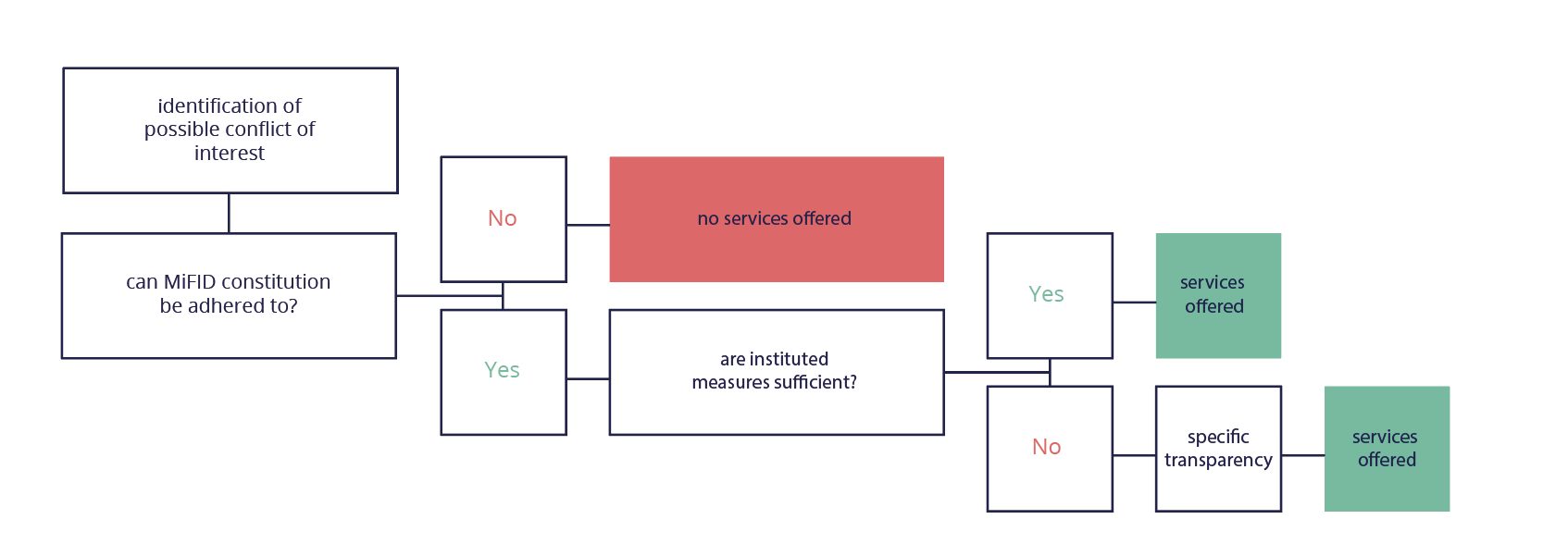

The following chart must be respected.

The conflict of interest handled with this special procedure must be recorded in the conflict of interest register.

6. Conflict of interest register

The conflict of interest register lists all identified conflicts of interest and the organisational measures Expat & Co has taken in response.

Any conflicts of interest that arise in future will be added to the register.

7. Remuneration

Expat & Co has drawn up a separate document (remuneration policy) for remuneration.

Please contact Expat & Co first for any questions or problems.

Complaints can also be submitted to

| Name | the Insurance Ombudsman |

| Address |

De Meeûssquare 35 |

| Telephone | +32 (0)2 547 58 71 |

| Fax | +32 (0)2 547 59 75 |

| Website | www.ombudsman.as |

The register of insurance intermediaries is kept by

| Name | FSMA |

| Address |

Congresstraat 12-14 |

| Telephone | +32 (0)2 220 52 11 |

| Fax | +32 (0)2 220 52 75 |

| Website | www.fsma.be |